Q: Do you have any suggestions on how to give scholarships to students? We award some each year, but my accountant says we can’t deduct them from our taxes. I feel like the only teacher who doesn’t know how to do that properly.

A: Offering scholarships to students whose financial situation does not allow them to participate or take an additional class is a well-intentioned idea. However, the practice of using a scholarship as a tax deduction is misunderstood. We asked certified public accountant Sean Dever, whose accounting firm focuses on services for the children’s sports education industry, to help set the record straight.

“A common misconception with scholarships is that they can be deducted on your corporate or personal tax returns,” says Dever. “But if you don’t actually spend money, you can’t take the deduction. Therefore, providing a scholarship in the form of not charging someone or offering a free class as a fundraiser would not be deductible, since you haven’t expended any form of money.”

An example of a legitimate deduction you can take on your taxes would be to write a check or purchase goods and give that donation to a nonprofit organization. This is considered deductible because you have paid money for these items and can show the financial transaction as proof.

We have personally found that rather than extending one or two scholarships to a select few people, it has been more beneficial to make participation more affordable for various groups of students. We offer discounts for: taking multiple classes, family enrollment, parents of a registered student, college students and mature dancers over 50.

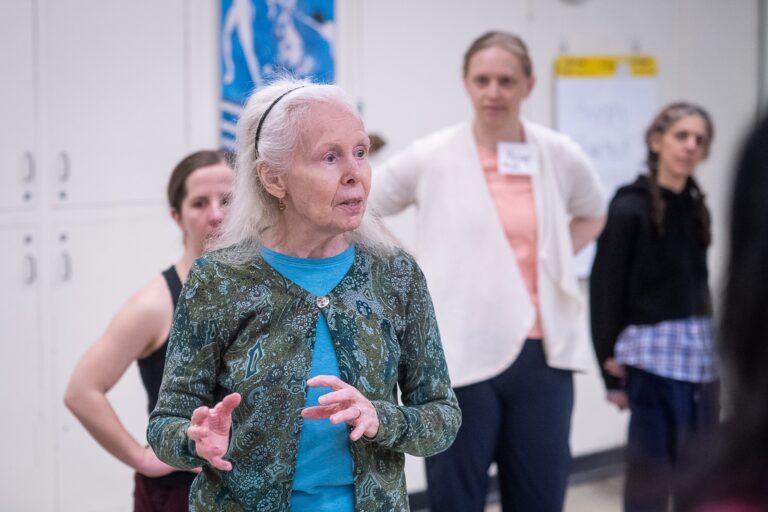

Kathy Blake is the owner of Kathy Blake Dance Studios in Amherst, New Hampshire. She and Suzanne Blake Gerety are the co-founders of DanceStudioOwner.com.